Personal Finance | 05 April 2023

Why investing could be a good long-term option for your cash

It’s important to keep cash for your short-term needs but, with year-on-year inflation above 10% in the UK, investing could be a good option for the future.

Everybody knows it’s a good idea to have cash. If you need to make a quick purchase or encounter an emergency, cash is there and ready to spend. However, if you’re planning for the future, it might be an idea to invest some of your money.

Cash held in a fixed-term savings account or put into ‘money market’ products – funds that invest in high-quality, short-term debt, cash, and cash equivalents – give a degree of safety. Fixed-term savings can be particularly useful for specific goals on the more immediate horizon because you can lock-in an interest rate, usually over a year or two.

But for growing your money over the long term – five years or more – investments act differently to cash because they can involve buying a share of a company, or ‘equity’.

Equity markets historically adjust to consider or ‘price in’ variables such as inflation and interest rates, as well as other factors such as supply chain shortages. This means equities often move down ahead of the impact of these variables on the economy, and then rise ahead of a recovery.

Investing for the long term

However, equity returns are unlikely to be as steady as a fixed rate in a savings account. Equity prices can rise at different times and in different markets and sectors.

Therefore, it could be beneficial to stay invested in equity markets for the long term to make the most of any rises and the value they could offer. While equity markets often move up or down based on short-term considerations, in the long run they tend to reflect the growth rate of corporate earnings as well as dividends, which tend to be positive. Historically, this can potentially provide higher returns than other assets as companies grow over time. By remaining invested for a longer period, that growth is reinvested, meaning your returns could compound over time.

Do remember, though, that the value of investments, and the income from them, can fall as well as rise and you may not get back what you put in. Past performance should not be taken as a guide to future performance. You should continue to hold cash for your short-term needs.

Investing vs inflation

While inflation can eat away at cash reserves, investing could help protect against rising prices, because the companies in which you invest may have the ability to pass increasing costs on to customers, meaning their earnings are less sensitive to rising prices. Historically, corporate equities have shown they can help deliver returns that rise above inflation at times.

Diversity

One way to manage the risk involved in investing is to hold a diversified investment portfolio. Diversified portfolios hold equities in different markets, regions and industrial sectors. This means they have limited exposure if one sector performs badly, and are also exposed to sectors that may be experiencing growth.

A diversified portfolio can also hold other assets such as bonds – or government or corporate debt. These can pay back a fixed rate over time and also be traded. Some fixed income assets, such as government bonds, are seen as being a ‘low risk of permanent capital loss’ investment, and a good way to offset the higher risk of equities. Typically, although not always, when equities fall, bond values rise as investors move to the relative safety they can provide.

A diversified portfolio will also hold some cash, which can be invested quickly if the time is right and the asset managers see an opportunity. By holding a range of assets for a long period, you may be able to realise returns over and above inflation.

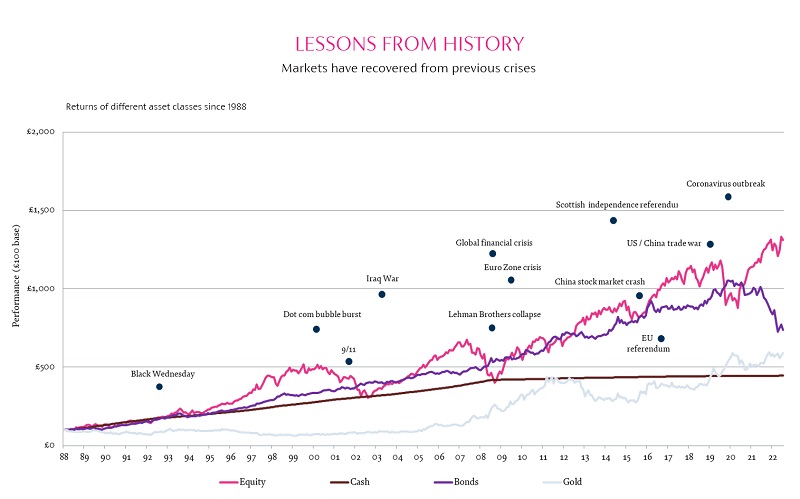

As we can see below, global equities have risen over time, even though there have been many major incidents.

Source: Refinitiv. MSCI UK £ used for Equity, Bloomberg gilt index used for Bonds, Gold Bullion price used for Gold, UK Sterling 3M deposit used for Cash. Returns include total returns and assume dividends reinvested, Data to 31 December 2022. Past performance should not be taken as a guide to future performance. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment.

Cash will always be important and useful. But over the long term, an investment portfolio that holds different assets in different markets could help you grow your wealth and help you meet your future financial goals.

To find out more please contact your Private Banker or Wealth Manager.

Advice and product fees may apply. You should continue to hold cash for your short-term needs.

More insights